In-depth Study and Development Prospects Report on China's Fiber Laser Industry (2025-2032)

Thanks to continuous technological advancements and the ongoing exploration of application potential, the downstream applications of fiber lasers in China are showing a flourishing trend of 'multiple highlights' and are continuously expanding into emerging fields. In recent years, the development of China's fiber laser industry has generally shown a growth trend, with the market size reaching 15.8 billion yuan in 2024 and expected to reach 19 billion yuan by 2025.

Notably, the pace of domestic substitution in China's fiber laser industry has accelerated, with the market share of domestic fiber lasers rising from 33.6% in 2017 to 86.2% in 2024. At present, China's low- and medium-power fiber lasers have been fully domestically replaced, but there is still room for improvement in the domestic production rate of high-power products. With ongoing breakthroughs in core technologies and accelerated product iteration, the domestic substitution process for high-power fiber lasers is expected to further accelerate in the future.

1. Overview of Fiber Lasers

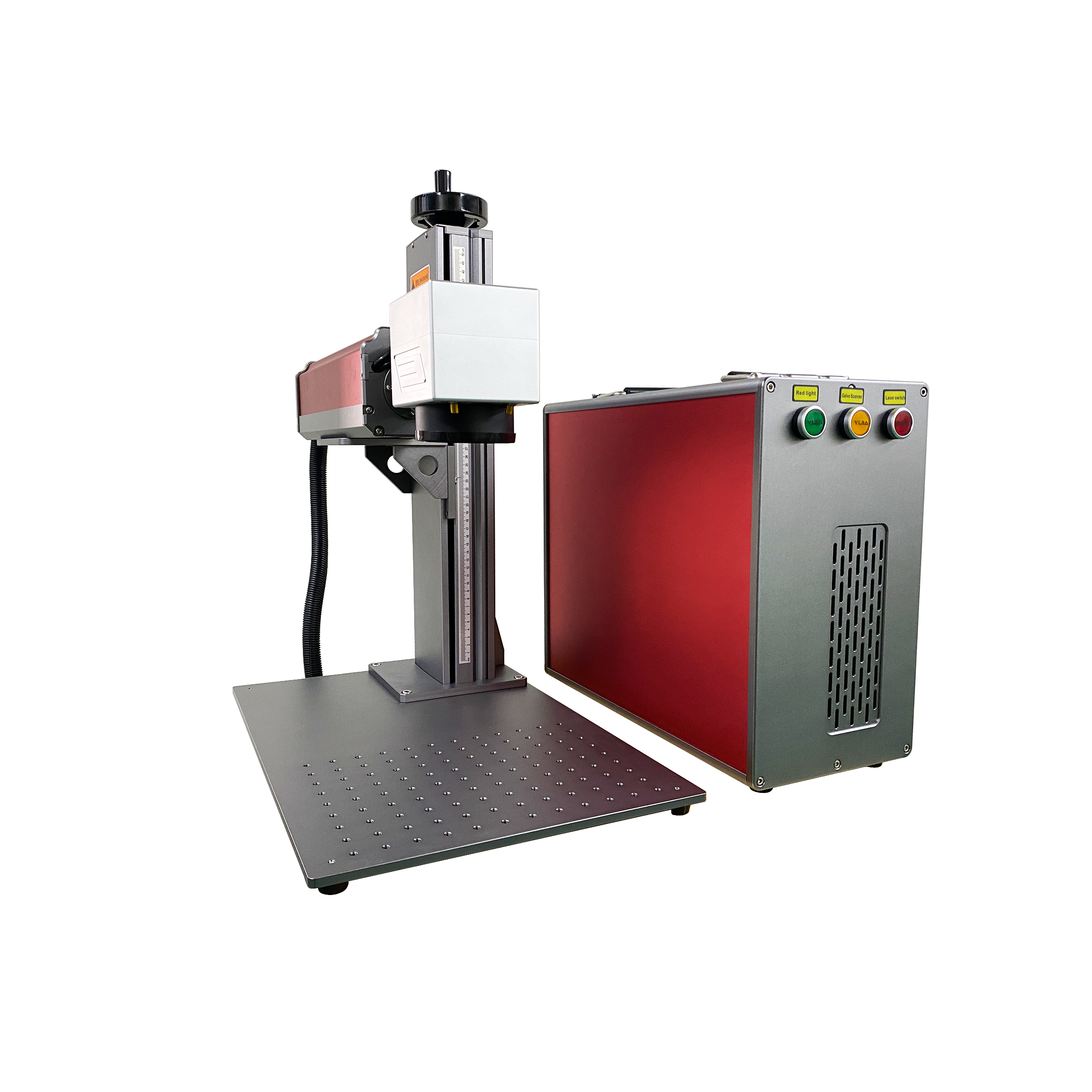

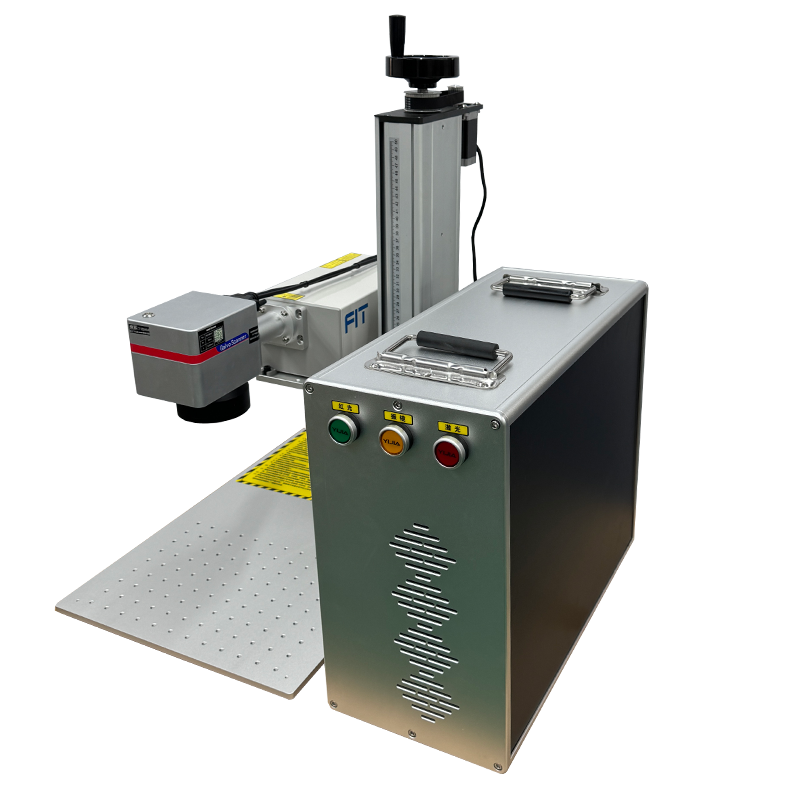

Fiber lasers refer to lasers that use rare-earth-doped glass fibers as the gain medium, and they belong to a new generation of solid-state lasers. They have advantages such as high photoelectric conversion efficiency, good beam quality, stable performance, good heat dissipation, compact structure, and high reliability. At present, fiber lasers have become the mainstream direction in laser technology development and a major force in laser industry applications. There are various ways to classify fiber lasers. For example, based on the laser operation mode, they can be divided into pulsed fiber lasers and continuous fiber lasers; based on the output laser power, they can be further categorized into low-power fiber lasers, medium-power fiber lasers, and high-power fiber lasers.

2. Downstream applications of fiber lasers flourish in multiple areas, with broad application prospects

Fiber lasers boast excellent performance and a wide range of uses, covering various processes such as welding, cutting, cladding, marking, drilling, rust removal, and even additive manufacturing (3D printing). Thanks to continuous technological advancements and the ongoing exploration of their application potential, the downstream applications of fiber lasers in China are experiencing a flourishing spread across multiple areas and continue to expand into emerging fields. Currently, their applications have penetrated key sectors of the national economy, including automobiles, ships, aerospace, metallurgy, rail transportation, new energy, medical devices, robotics, and 3C electronics, showing extremely broad development prospects.

For example, in the automotive field, fiber lasers are indispensable for laser welding of car roofs and laser hardening of engine parts. As the world's largest automobile producer and consumer, China's enormous automotive industry provides extremely fertile ground for the application of fiber lasers. Data shows that in 2024, China's automobile production and sales both surpassed 31 million units, setting a new historical record and maintaining the top spot globally for 16 consecutive years.

In the field of robotics, fiber lasers can be used for laser cutting and welding in industrial robots, significantly improving the efficiency and precision of these processes. China has become the world's largest producer of industrial robots, with production rising from 186,900 units in 2019 to 556,400 units in 2024, driving increased demand for high-precision, high-efficiency laser cutting and welding technologies, thereby boosting the fiber laser market. Notably, in the promising field of humanoid robots, fiber lasers also hold great potential. They can serve as a powerful tool in the manufacturing process of humanoid robots, being applied in metal processing, energy component manufacturing, and more. It is foreseeable that, with the acceleration of the commercialization of humanoid robots, the penetration rate of fiber lasers in the robotics industry chain will further increase, injecting new vitality into the innovative development of the entire industry.

3. Expansion of the Fiber Laser Market

In recent years, with the continuous advancement of intelligent and precise transformation and upgrading in China's manufacturing industry, fiber lasers, as core equipment for advanced manufacturing, have shown an overall growth trend in the industry. Data shows that the market size of fiber lasers increased from 8.26 billion yuan in 2019 to 15.8 billion yuan in 2024, with a compound annual growth rate of approximately 13.85%.

This growth is mainly driven by three key factors: first, the transformation and upgrading of the manufacturing industry has driven the demand for innovations in production processes, leading to a continuous increase in the penetration of fiber lasers in the industrial processing sector; second, the strong development of downstream application markets such as automobiles, robotics, and aerospace has injected growth momentum into the fiber laser industry; finally, technological innovation continues to enhance the performance of fiber laser products, further expanding their application boundaries. As downstream application fields continue to deepen and expand, and with the manufacturing industry's transformation and the replacement of traditional processes by laser technology, China's fiber laser industry is expected to maintain a positive growth trend in 2025.

4. The market share of domestic fiber lasers continues to rise, with room for improvement in the localization rate of high-power products.

In the early stages, the competitive landscape of China's fiber laser market was mainly dominated by foreign companies such as IPG, with a low localization rate. However, as local companies like Raycus Laser and Maxphotonics have continuously overcome core technological bottlenecks, the power levels and performance indicators of domestic fiber lasers have rapidly improved. Against this backdrop, the pace of domestic substitution in China's fiber laser industry has accelerated, along with an increase in the localization rate. Data show that the market share of domestic fiber lasers jumped from 33.6% in 2017 to 86.2% in 2024, achieving a fundamental shift from technology follower to market leader. This development trajectory fully demonstrates the significant progress in technology and market competitiveness of domestic fiber lasers. From the enterprise perspective, in 2023, China’s fiber laser industry achieved major breakthroughs, with the two leading local companies, Raycus Laser and Maxphotonics, both increasing their market shares, surpassing IPG to take the first and second positions in the industry.

Post time: 01-09-2026