The global market for large laser engraving machines will reach $844 million by 2031 (CAGR 6.3%)

Latest Market Research Report

PART 1 Product Definition and Applications

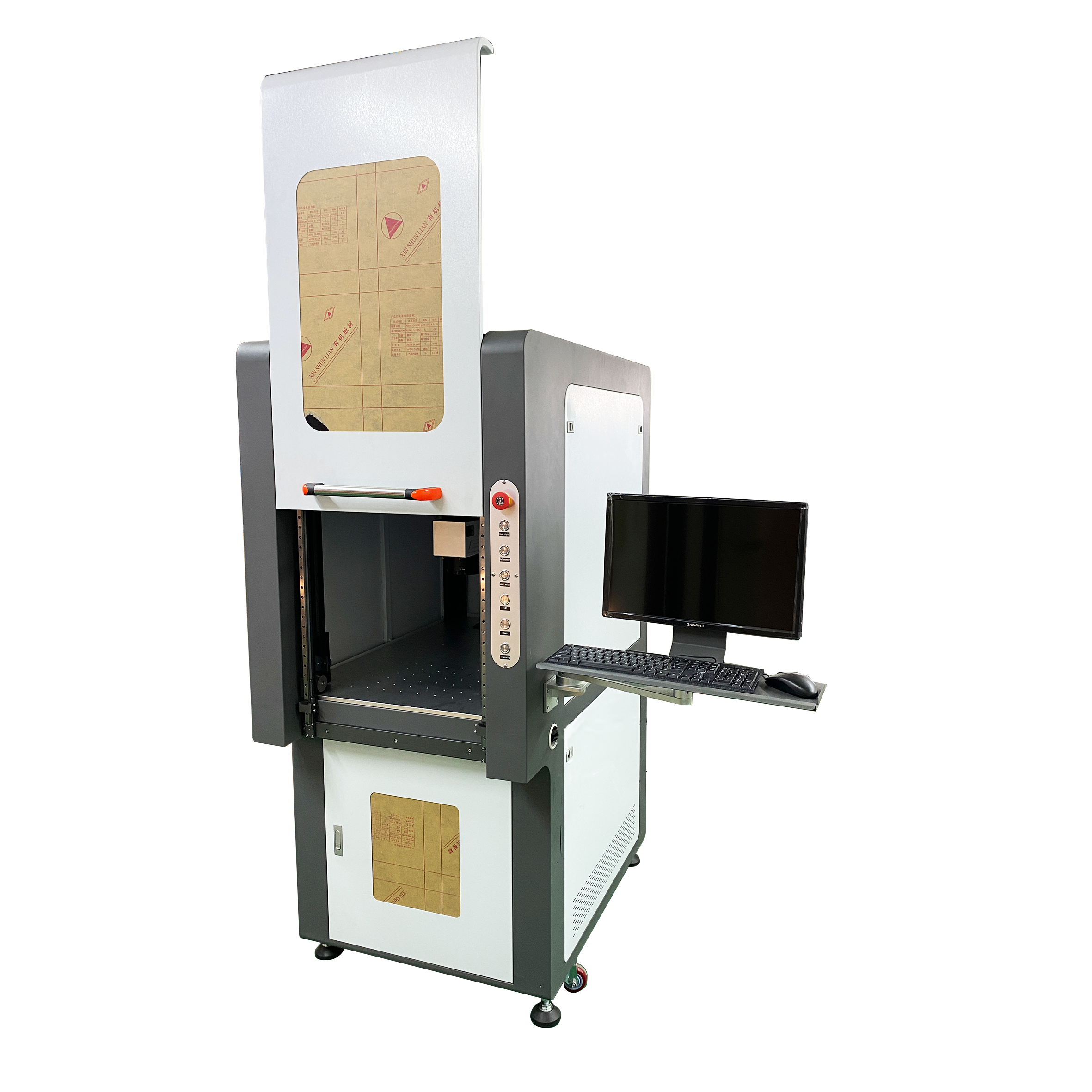

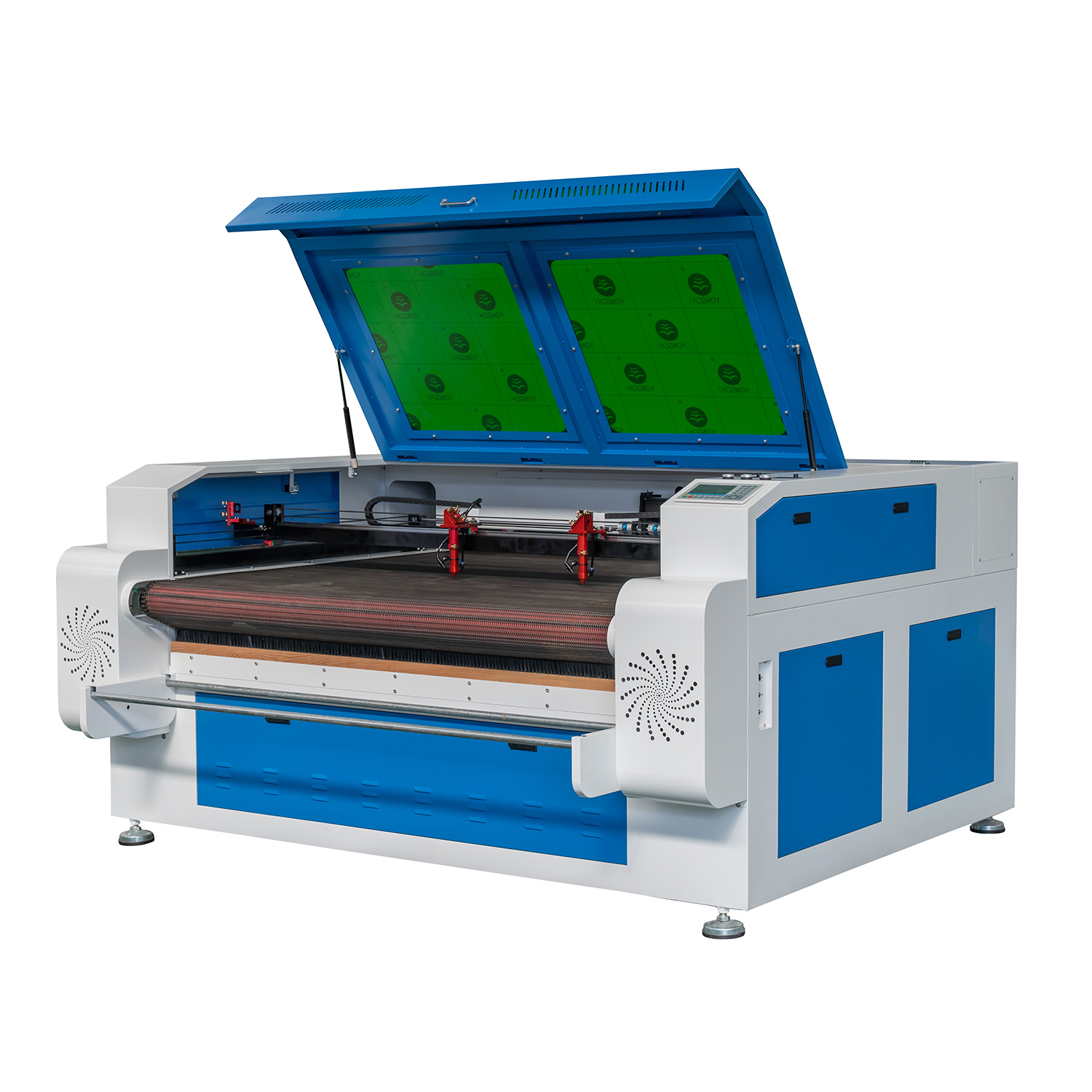

Large laser engraving machines are advanced processing equipment that use high-power laser beams to perform fine cutting, engraving, and marking on the surfaces of metals, non-metals, and composite materials. They usually have a large worktable, making them suitable for large-sized workpieces or mass production. The core principle is that the laser generates a high-energy-density beam, which is focused onto the material surface through an optical system, causing the material to instantly melt, vaporize, or undergo photochemical reactions, thereby enabling precise engraving.

These machines are typically equipped with CNC systems, automatic focusing mechanisms, and multi-axis motion platforms to ensure high precision and repeatability. Large laser engraving machines are widely used in fields such as advertising signs, furniture decoration, mold manufacturing, automotive parts, aerospace, and electronics industries. They offer characteristics such as flexible processing, high efficiency, contactless operation, and compatibility with a wide range of materials. Their development trends focus on increasing automation, integrating intelligent monitoring and remote maintenance functions, and applying environmentally friendly laser sources to meet the modern manufacturing industry's demands for efficient, green, and precise processing.

PART 2 Overall Global Market Size

According to the latest research report by Global Info Research, '2025 Global Market Large Laser Engraving Machine Overall Scale, Major Manufacturers, Key Regions, Product and Application Segmentation Research Report -- Global Info Research,' it is expected that the global market size for large laser engraving machines will reach $844 million by 2030, with a compound annual growth rate (CAGR) of 6.3% in the coming years.

PART 3 Manufacturer Rankings and Market Share

Globally, major manufacturers of large laser engraving machines include AtomStack/Kern Laser Systems, Epilog Laser, THUNDER LASER, Gravotech, TYKMA Electrox, Trotec Laser GmbH, Wattsan, Ketai Laser, Han's Laser, Ruijie Laser, MAC LASER, EMITLASER, DXTECH GROUP LTD., STYLECNC, Mactron Tech, Linxuan Laser, among others, with the top five manufacturers holding approximately 50% of the market share.

Industry Development Trends

The large laser engraving machine market as a whole is showing a trend of rapid growth alongside technological upgrades. Its core driving force comes from the demand for process innovation driven by the digitalization and intelligent transformation of global manufacturing. With its high precision, large-format processing, and multi-material adaptability, this equipment is gradually replacing traditional machining methods and is widely used in fields such as automotive parts, aerospace structural components, custom furniture, mold manufacturing, and advertising signage. It is also further extending into the precision manufacturing of industrial functional components.

In terms of market patterns, China has become the largest production and consumption market, leveraging a complete industrial chain and cost advantages, while Europe and the United States maintain a lead in high-end equipment and industrial application solutions. Japan and Germany continue to hold strong positions in optical components and precision control. Future industry competition will focus on high-power light sources, intelligent control systems, and automated production integration. The equipment will be deeply integrated with the industrial internet and artificial intelligence, promoting personalized customization and flexible production models. Overall, large laser engraving machines are not only important tools for upgrading the equipment manufacturing industry but will also play a strategic role in the development of new material processing and high-end manufacturing. The market is expected to maintain a double-digit compound growth rate over the next five years.

Market Competition Landscape

1. International Leading Companies: Such as TRUMPF and Bystronic, relying on strong R&D capabilities and a comprehensive global sales network, occupy the high-end market. Their main competitive advantages lie in technological innovation, precision control, and multifunctional integration.

2. Domestic Chinese Manufacturers: Such as Han's Laser, Jinyun Laser, and Huagong Technology, leverage price advantages, rapid customization capabilities, and a well-established after-sales service system, forming strong competitiveness in the mid-range market and domestic demand side, while gradually breaking into the high-end market.

3. Regional Small and Medium-Sized Enterprises: Concentrated in Southeast Asia, India, and certain European countries, mainly depending on regional customer resources. Their products are mostly positioned in the mid-to-low-end market, and their competitiveness lies in flexibility and cost control.

4. Emerging Innovative Enterprises: Some companies enter the market through intelligence, automation, AI monitoring, and process optimization, forming differentiated competition. Their target customer base includes smart manufacturing, 3C electronics, and high-precision processing sectors.

Overall, the competitive structure of the large laser engraving machine market shows a three-layer pattern of "international giants dominating the high-end—rapid rise of Chinese manufacturers—regional companies deeply cultivating local markets." In the future, with the growth of smart manufacturing and personalized processing demands, competition will further focus on high-precision processing, automation integration, and cost efficiency. Leading companies are expected to continue expanding through technological iteration and globalization, while SMEs will need to survive relying on differentiated positioning and regional advantages.

Industry Chain Analysis

The industry chain of large laser engraving machines is a technology-intensive, well-segmented system, covering the entire chain from core light sources to end applications.

Upstream: Supply of Core Components and Raw Materials

The upstream of the industrial chain is the segment with the highest technological barriers and the most concentrated value, primarily providing the 'heart' and 'brain' of laser engraving machines. The laser is the absolute core, and its type (CO₂, fiber, ultraviolet) and power directly determine the processing capability and application area of the equipment. The global market is dominated by major players such as IPG in the United States, TRUMPF in Germany, and Coherent in the United States, while Chinese companies like Han’s Laser and Ruike Laser are also rapidly rising to become important suppliers. The CNC system acts as the 'brain' of the equipment, responsible for motion control and trajectory accuracy, with major players in this field including Germany’s Siemens, Japan’s FANUC, and China’s Zhongwei and Bochu Electronics. In addition, the quality of precision optical components (such as galvanometers, focusing lenses, and mirrors) directly affects processing accuracy and efficiency, with representative companies being Germany’s Scanlab and China’s Jinhai Chuang. Mechanical components (such as high-precision screws, guide rails, and machine frames) and auxiliary systems (such as cooling systems and exhaust dust removal systems) together form the foundation for the stable operation of the equipment.

Midstream: Complete machine design, manufacturing, and integration

The midstream segment is crucial for integrating various upstream components into a complete device. The design and development of the entire machine are central to value creation, and manufacturers need to carry out comprehensive design of optics, structure, electronics, and software according to the target market (such as metal cutting or non-metal engraving), while ensuring stability and ease of use. In the manufacturing and assembly stage, companies can be categorized into several types: first, vertically integrated giants (like Han’s Laser) that can produce their own lasers, light sources, and some core components; second, specialized assembly manufacturers that purchase all core components and focus on frame design, system integration, and final assembly. This stage tests a company's supply chain management, production processes, and quality control capabilities. Finally, there is software and control system integration, where equipment manufacturers develop or integrate dedicated control software, perfectly combining CNC systems with lasers, galvanometers, and other drives, while providing a user-friendly interface. This is an important step in creating product differentiation and enhancing user experience.

Downstream: App Market, Sales Channels, and Value-Added Services

The downstream of the industrial chain is the end point for value realization, connecting to a wide range of end-user markets. The application markets are highly diverse, mainly including industrial manufacturing (such as automotive parts marking, sheet metal cutting, and apparel and leather cutting), advertising signage (acrylic and wooden plaque engraving), printing and packaging (mold engraving), handicrafts and gifts (personalized engraving), as well as scientific research and education. Sales and service channels are equally varied, including direct sales (for major clients and industry solutions), distributor/agent networks (covering regional markets), and the increasingly important online e-commerce platforms (particularly for small and desktop-level equipment). Finally, value-added services have become a core competitive advantage for manufacturers, including installation and commissioning, technical training, after-sales maintenance, equipment rental, and the provision of consumables and parts. These services not only provide a continuous revenue stream but are also key to building brand loyalty and establishing a competitive moat.

Post time: 12-10-2025